If you are an online seller or e-commerce business owner, you may be aware of the new EU VAT rules that took effect on 1st July 2021. The rules are part of the EU's effort to modernize VAT rules for cross-border e-commerce, making it easier for businesses to sell goods and services across the EU. One of the significant changes is the introduction of the Import One-Stop Shop (IOSS).

With the IOSS, customers no longer have to pay VAT at the time of import, making the buying process smoother and more efficient.

What is IOSS?

IOSS is a simplified VAT scheme that allows EU businesses to collect, declare and pay VAT for their sales of imported goods up to a value of €150. IOSS makes it easier for online sellers to comply with VAT obligations when selling goods from third countries to customers in the EU. Instead of requiring customers to pay VAT at the time of import, the VAT is collected by the seller at the time of sale, and the seller is responsible for remitting the VAT to the appropriate tax authority.

The IOSS applies to goods imported from non-EU countries with a value of up to €150. The IOSS is optional but highly recommended as it makes it easier for businesses to comply with VAT obligations and avoid the need to register for VAT in multiple EU countries.

How does IOSS work?

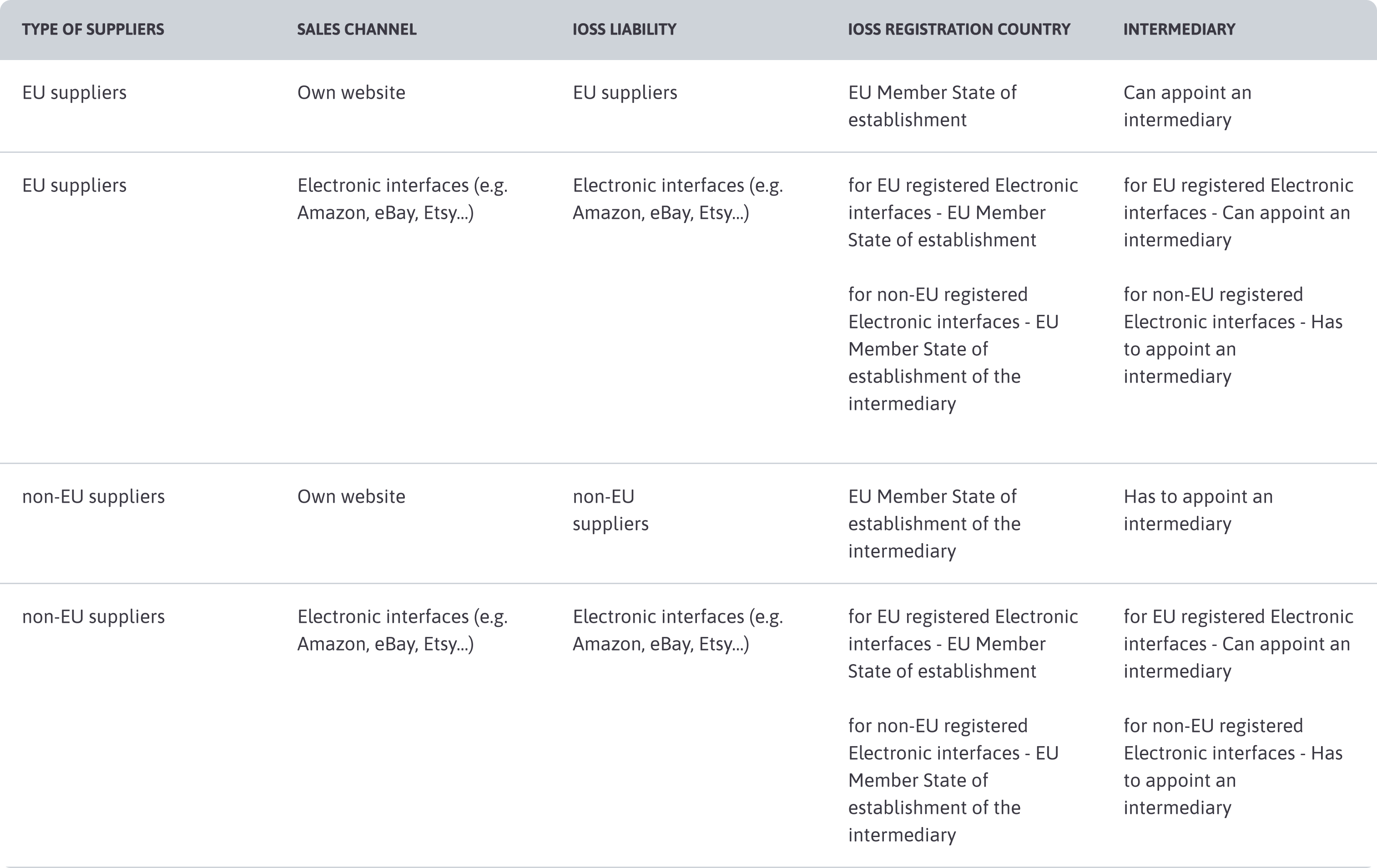

To use the IOSS, businesses need to register with the tax authorities of an EU member state where they are established or have a fixed establishment. Once registered, businesses are assigned a unique IOSS identification number, which they need to provide to their online marketplace or platform.

When a sale is made to an EU customer, the seller collects the VAT due on the sale and includes it in the price paid by the customer. The seller then reports the VAT collected in a monthly or quarterly VAT return to the tax authorities in the member state where they are registered for the IOSS. The tax authorities will distribute the VAT collected to the relevant member states based on the customer's location.

What are the benefits of using IOSS?

The IOSS provides a range of benefits for online sellers and e-commerce businesses.

Some of the benefits include:

- Easier VAT compliance: The IOSS simplifies the VAT compliance process by allowing sellers to collect and report VAT in one EU member state, rather than registering for VAT in multiple member states.

- Improved customer experience: With the IOSS, customers no longer have to pay VAT at the time of import, making the buying process smoother and more efficient.

- Reduced customs delays: As VAT is collected at the time of sale, customs delays can be reduced, allowing goods to be delivered to customers more quickly.

- Competitive advantage: By using IOSS, businesses can avoid passing on the cost of VAT to customers, making their products more attractive to EU consumers.

- Reduced VAT costs: For businesses that regularly sell goods valued under €150 to customers in the EU, the IOSS can help reduce VAT costs, as it eliminates the need to pay VAT at the time of import.

Conclusion

The IOSS is a significant development in the EU's VAT rules for cross-border e-commerce. The scheme provides businesses with a simplified way to comply with VAT obligations, making it easier and more efficient to sell goods and services across the EU. With the IOSS, businesses can provide a better customer experience, reduce customs delays, and gain a competitive advantage by offering VAT-inclusive prices to EU customers. While the IOSS is optional, it is highly recommended for businesses that sell goods valued under €150 to EU customers.